Established in 1994, 360 ONE Prime Limited functions as an asset management entity, specializing in portfolio and wealth management, treasury operations, consulting, financial planning, and investment oversight services. This firm operates as a subsidiary of 360 ONE WAM, recognized as a premier private wealth management organization in India. Located in Mumbai, 360 ONE Prime Limited underwent a name change in 2022; previously recognized as IIFL Wealth Prime Limited, it rebranded to emphasize a comprehensive perspective denoted by “360” and a client-focused ethos represented by “ONE.” The company maintains a significant domestic presence across 15 states and extends its reach globally, operating in five different countries. As of the fiscal year 2023, its operational revenue stood at ₹673.66 crore. Furthermore, as of September 30, 2023, the firm’s loan portfolio amounted to ₹5,310 crore. Notably, 360 ONE Prime NCD IPO has secured an AA rating from ICRA, a testament to its credibility and reliability among major institutional investors.

Over its operational span, the company has facilitated financing solutions for more than 1,000 clients, aiding them in diverse endeavors such as market investments, fulfilling short-term capital needs, securing early-stage debt, and executing substantial acquisitions.

360 ONE Prime NCD IPO January 2024 Detail

| Issue Open | January 11, 2024 – January 24, 2024 |

| Security Name | 360 ONE Prime NCD IPO Limited |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 1,000.00 Crores |

| Issue Size (Shelf) | Rs 1,500.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE |

| Credit Rating | “CRISIL AA/Stable” by CRISIL Ratings Limited and “[ICRA]AA (Stable)” by ICRA Limited |

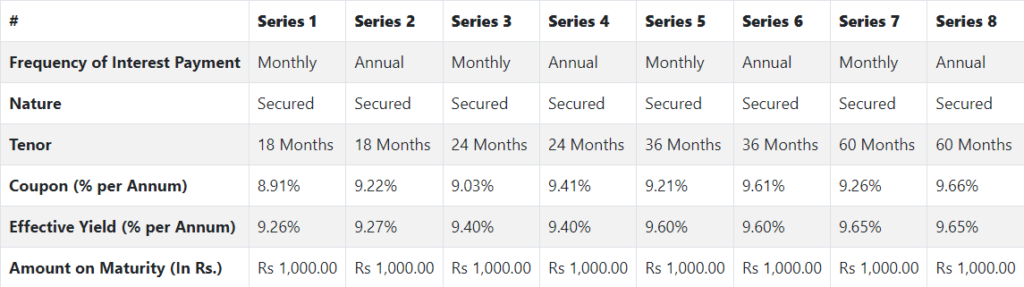

| Tenor | 18,24 ,36 and 60 months |

| Series | Series I to VIII |

| Payment Frequency | Monthly and Annually |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Beacon Trusteeship Limited |

NCD Allocation Ratio

360 ONE Prime NCD IPO Coupon Rates

NCD Rating

The NCDs proposed to be issued under this Issue have been rated CRISIL AA/Stable by CRISIL Ratings Limited and ICRA AA (Stable) by ICRA Limited with such ratings considered to have a stable outlook.

Company Promoters

The promoter of the company is 360 ONE WAM Limited.

Company Financials

360 ONE Prime NCD IPO Limited Financial Information (Restated)

360 ONE Prime Limited’s revenue decreased by -10.72% and profit after tax (PAT) dropped by -17.07% between the financial year ending with March 31, 2023 and March 31, 2022.

| Period Ended | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 7,719.70 | 6,795.83 |

| Revenue | 673.66 | 754.58 |

| Profit After Tax | 234.52 | 282.80 |

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- For onward lending, financing /refinancing the company’s existing indebtedness, and debt servicing (payment of interest and repayment/prepayment of interest and principal of existing borrowings of the company.

- General corporate purposes.

Keep reading and supporting Banknomics!