Founded in 2012, Navi Finserv Limited stands as a prominent non-deposit-taking NBFC (Non-Banking Financial Company) acknowledged by the RBI (Reserve Bank of India). Functioning as a wholly-owned subsidiary of Navi Technologies Limited, the company has made strides in the financial sector. Notably, Navi Finserv Limited recently made headlines with its successful Navi Finserv NCD IPO, marking a significant milestone in its journey.

Navi Finserv Limited provides various financial services, including digital personal loans, home loans, and real estate loans, primarily through its mobile application, the Navi app. Formerly known as Chaitanya Rural Intermediation Development Services Private Limited, the company has transitioned to focus on digital finance solutions.

The company adopts a mobile-centric approach, emphasizing its Navi app for delivering personal and home loan services. Additionally, it has developed its proprietary cloud-native platform called the Navi Lending Cloud. This platform facilitates real-time lending partnerships by allowing partners to assess customers and set loan parameters instantly. Moreover, it streamlines collection payments to co-lenders and manages reconciliation processes efficiently. Furthermore, for direct portfolio allocation, it offers a straightforward pool selection process along with due diligence procedures.

As of September 30, 2023, the company had 955 employees.

Navi Finserv NCD IPO February 2024 Detail

| Issue Open | February 26, 2024 – March 7, 2024 |

| Security Name | Navi Finserv Limited |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 300.00 Crores |

| Issue Size (Oversubscription) | Rs 300.00 Crores |

| Overall Issue Size | Rs 600.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE, NSE |

| Credit Rating | CRISIL A/Stable by CRISIL. |

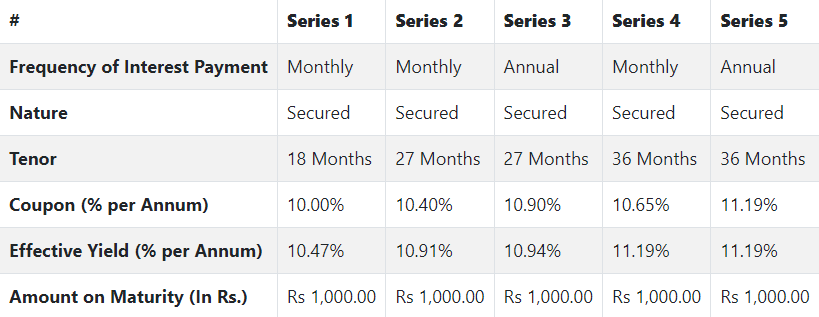

| Tenor | 18, 27 and 36 months |

| Series | Series I to V |

| Payment Frequency | Monthly and Annually |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Catalyst Trusteeship Limited |

Navi Finserv NCD IPO Allocation Ratio

Navi Finserv Limited NCD IPO Coupon Rates

Navi Finserv NCD IPO Rating

The NCDs proposed to be issued pursuant to this Issue have been rated CRISIL A/Stable by CRISIL.

Company Promoters

The company’s Promoter is Navi Technologies Limited.

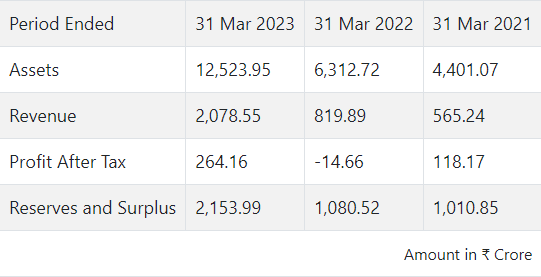

Company Financials

Navi Finserv Limited Financial Information (Restated Consolidated)

Navi Finserv Limited’s revenue increased by 153.52% and profit after tax (PAT) rose by 1902.04% between the financial year ending with March 31, 2023 and March 31, 2022.

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- For the purpose of onward lending, financing, and repayment of existing loans and borrowings of the company.

- General corporate purposes.

Keep reading and supporting Banknomics!