Chemmanur Credits and Investments Limited, a reputable non-deposit-taking, non-banking financial company registered with the Reserve Bank of India, specializes in various financial services.

The core focus of Chemmanur Credits and Investments Limited, often referred to as “CCIL,” is providing financial solutions related to gold. CCIL primarily operates in the states of Kerala, Tamil Nadu, and Karnataka, where it extends loans against the security of household gold jewelry, commonly known as “Gold Loans.”

In addition to Gold Loans, CCIL diversifies its financial offerings by providing Microfinance Loans, business and personal loans, facilitating secure money transfer services, and offering a wide array of third-party insurance products.

With over 11 years of experience in the lending sector, Chemmanur Credits and Investments Limited NCD IPO is headquartered in the vibrant state of Kerala, India. As of September 30, 2023, CCIL’s extensive reach encompasses 222 branches spanning five states, including Kerala, Tamil Nadu, Karnataka, Maharashtra, and Andhra Pradesh. These branches are efficiently managed from the company’s registered office situated in Thrissur, Kerala. In total, CCIL employs a dedicated workforce of 1172 individuals to ensure seamless business operations.

Worth noting is that Chemmanur Credits and Investments Limited NCD IPO is a subsidiary of the Boby Chemmanur Group, an illustrious conglomerate with diverse business interests, also headquartered in Kerala, India. Among its achievements, the Boby Chemmanur Group boasts retail gold jewelry showrooms not only in India but also in the USA and the Middle East. Furthermore, the group has earned recognition through the prestigious BIS certification for the purity of its gold products.

Chemmanur Credits and Investments NCD October 2023 Detail

| Issue Open | October 16, 2023 – October 30, 2023 |

| Security Name | Chemmanur Credits and Investments Limited |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 50.00 Crores |

| Issue Size (Shelf) | Rs 100.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE |

| Credit Rating | CRISIL BBB-/Stable |

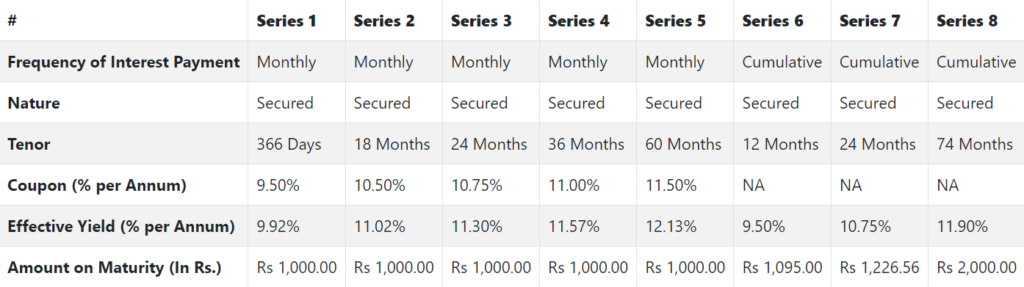

| Tenor | 366 days, 18, 24, 36, 60, 12 and 74 months |

| Series | Series I to VIII |

| Payment Frequency | Monthly and Cumulative |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Mitcon Credentia Trusteeship Services Limited |

NCD Allocation Ratio

Chemmanur Credits and Investments Limited NCD IPO Coupon Rates

NCD Rating

The NCDs proposed to be issued have been rated ‘CRISIL BBB-/Stable’ by CRISIL Ratings Limited.

Company Promoters

Chemmanur Devassykutty Boby is the company promoter.

Objects of the Issue

The company proposes to utilise the funds which are being raised through the Issue:

1. For the purpose of onward lending, financing, and for repayment/prepayment of principal and interest on borrowings of the Company.

2. General corporate purposes.

In conclusion

Chemmanur Credits and Investments Limited NCD IPO, commonly known as “CCIL,” stands as a reputable and dynamic non-deposit-taking, non-banking financial institution registered with the Reserve Bank of India. With a primary focus on gold-related financial solutions, CCIL operates in the states of Kerala, Tamil Nadu, and Karnataka, offering Gold Loans, among other services such as Microfinance Loans, business and personal loans, secure money transfer services, and a diverse range of third-party insurance products.

Keep reading and supporting Banknomics!