Founded in 1986, Indel Money Limited is a registered non-deposit-taking non-banking finance company (NBFC), overseen by the Reserve Bank of India (RBI). With a focus on the gold loan sector, the company provides financial support by utilizing household gold jewelry as collateral. In addition to its expertise in gold loans, Indel Money NCD IPO also caters to diverse financial needs, offering loans against property, business loans, and personal loans.

As of September 30, 2023, the company’s total loans and advances stood at ₹67,132.98 lakhs. Notably, for Fiscal 2023, 2022, and 2021, the figures were ₹50,635.60 lakhs, ₹42,135.99 lakhs, and ₹30,994.35 lakhs, respectively. These values account for 82.13%, 78.18%, 80.46%, and 77.71% of the total, respectively.

Indel Money’s clientele for gold loans predominantly hails from rural and semi-urban areas. The company boasts a network of 250 branches across Kerala, Tamil Nadu, Karnataka, Odisha, Maharashtra, Telangana, and the union territory of Puducherry as of September 30, 2023. To streamline operations, the company utilizes a web-based centralized IT platform that records branch details and manages loan-related information. Indel Money has also introduced web applications on both the Google Play Store and the iOS App Store. Additionally, the company has enhanced business efficiency through its web-based payment portal, E-Connect.

As of September 30, 2023, the company’s workforce comprised a total of 1,201 employees.

Key Competitive Strengths of the Company:

- Pioneering Position: The company holds a prominent position as a non-deposit-taking NBFC in the Gold Loan sector in South India, backed by a substantial operating history.

- Customer-Centric Long-Term Gold Loan Schemes: Distinguishing itself, the company offers customer-friendly long-term gold loan schemes that contribute to its competitive edge.

- Convenient Doorstep Delivery: Setting itself apart in customer service, the company provides doorstep delivery of gold loans, enhancing accessibility and convenience for its clients.

- Robust Branch Network: The company boasts a well-established and expanding branch network, strategically positioned across rural and semi-urban areas in South India, thereby strengthening its market presence.

- Expert Leadership and Skilled Workforce: A significant competitive strength lies in the company’s experienced management team and skilled personnel. This adept team contributes to the overall efficiency and strategic decision-making of the organization.

Indel Money NCD IPO January 2024 Detail

| Issue Open | January 30, 2024 – February 12, 2024 |

| Security Name | Indel Money Limited NCD IPO |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 100.00 Crores |

| Issue Size (Shelf) | Rs [.] Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE |

| Credit Rating | CRISIL BBB+/Stable by by CRISIL Ratings Limited |

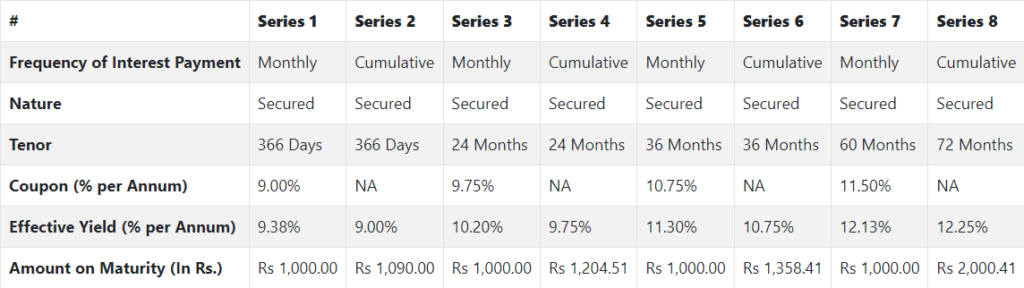

| Tenor | 366 days, 24, 36, 60 and 72 months |

| Series | Series I to VIII |

| Payment Frequency | Monthly and Cumulative |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Catalyst Trusteeship Limited |

Indel Money NCD IPO Allocation Ratio

Indel Money Limited NCD IPO Coupon Rates

Indel Money NCD IPO Rating

The NCDs proposed to be issued under this Issue have been rated CRISIL BBB+/Stable by CRISIL Ratings Limited. With this rating, they are considered to have a moderate degree of safety and moderate credit risk.

Company Financials

Indel Money Limited NCD IPO Financial Information (Restated Consolidated)

Indel Money Limited’s revenue increased by 52.28% and profit after tax (PAT) rose by 871.56% between the financial year ending with March 31, 2023 and March 31, 2022.

| Period Ended | 31 Dec 2023 | 31 Mar 2023 | 31 Mar 2022 | 31 Mar 2021 |

| Assets | 1,133.80 | 1,013.90 | 736.80 | 502.20 |

| Revenue | 143.40 | 187.30 | 123.00 | 94.70 |

| Profit After Tax | 28.60 | 20.50 | 2.11 | 8.70 |

| Net Worth | ||||

| Amount in ₹ Crore | ||||

Objects of the Issue

The Company proposes to utilize the funds towards funding the following objects:

- For the purpose of onward lending, financing, and for repayment/prepayment of principal and interest on borrowings of the Company

- General corporate purposes.

Keep reading and supporting Banknomics!