Established in May 2005, Motilal Oswal Financial Services Limited stands out as a comprehensive brokerage firm in India, boasting the highest gross brokerage revenue among its competitors in the industry as of March 31, 2023. Within the Motilal Oswal Group, a wide array of financial services is offered, including broking, investment banking, asset management, private equity, wealth management, and housing finance.

The company caters to a diverse clientele, ranging from retail customers (including high net worth individuals) to mutual funds, foreign institutional investors, financial institutions, and corporate clients, serving as both a stock and commodities broker. This service is provided through three primary channels: a vast network of over 2,500 Business Locations spanning more than 550 cities in India as of March 31, 2024; online and digital platforms, including mobile applications; and a network of over 8,000 Business Associates located across various regions in India as of March 31, 2024.

With a presence across 22 states, two union territories, and one international location, the company employs 7,927 individuals as of March 31, 2024, ensuring a nationwide reach. The company’s broking services extend throughout various states via its online and digital platforms, seamlessly integrated with its network of Business Locations and Business Associates, providing clients with a streamlined trading and investment experience. This strategic positioning positions the company to capitalize on the growth of the Indian financial market, the increasing emphasis on digitization, and the expanding returns from financial investments.

As of March 31, 2024, the company’s workforce consists of 11,290 full-time employees, reflecting its commitment to continued growth and service excellence.

Motilal Oswal Financial Services NCD IPO April 2024 Detail

| Issue Open | April 23, 2024 – May 7, 2024 |

| Security Name | Motilal Oswal Financial Services Limited NCD IPO |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 500.00 Crores |

| Issue Size (Oversubscription) | Rs 500.00 Crores |

| Overall Issue Size | Rs 1,000.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE, NSE |

| Credit Rating | CRISIL AA/Stable by CRISIL Ratings Limited |

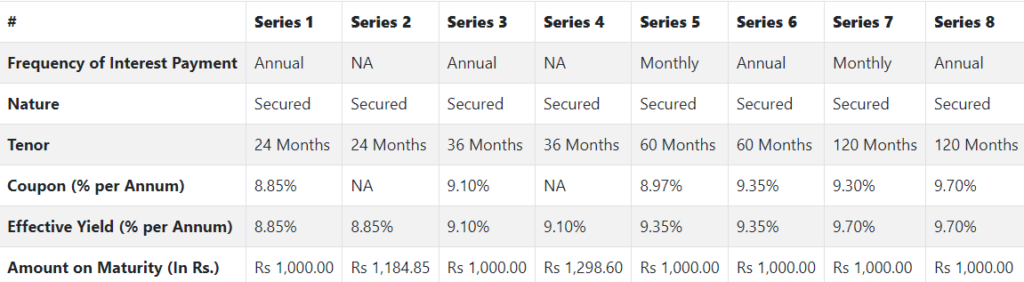

| Tenor | 24, 36, 60 and 120 months |

| Series | Series I to VIII |

| Payment Frequency | Monthly and Annually |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Beacon Trusteeship Limited |

Motilal Oswal Financial Services NCD IPO Allocation Ratio

Motilal Oswal Financial Services Limited NCD IPO Coupon Rates

Motilal Oswal Financial Services NCD IPO Rating

The proposed issuance of NCDs has received a rating of “CRISIL AA/Stable” from CRISIL Ratings Limited.

Company Promoters

The company’s promoters include Motilal Oswal, Raamdeo Agarawal, and the Motilal Oswal Family Trust.

Company Financials

Motilal Oswal Financial Services Limited Financial Information (Restated Consolidated)

Motilal Oswal Financial Services Limited’s revenue decreased by -2.76% and profit after tax (PAT) dropped by -28.93% between the financial year ending with March 31, 2023 and March 31, 2022.

| Period Ended | 30 Sep 2023 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 29,184.48 | 23,009.94 | 169,323.34 |

| Revenue | 3,181.06 | 4,197.12 | 4,316.41 |

| Profit After Tax | 1,059.52 | 932.82 | 1,312.45 |

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- For the purpose of meeting working capital requirements and repayment of existing liabilities

- General corporate purposes

Keep reading and supporting Banknomics!