Established in the year 1997, Muthoot Fincorp NCD Limited stands as a non-deposit-taking Non-Banking Financial Company (NBFC). The core focus of the organization revolves around extending secured loans, both personal and business-oriented, backed by gold ornaments and jewelry. These gold-backed loans cater to the short-term liquidity needs of individuals.

As of June 30, 2023, Muthoot Fincorp Limited boasted a gold loan portfolio that encompassed approximately 31 lakhs of loan accounts, reflecting the company’s substantial market presence.

Operational excellence is a hallmark of Muthoot Fincorp Limited, with a widespread network comprising 3,619 branches spanning 24 states, including the union territory of Andaman and Nicobar Islands, as well as the national capital territory of Delhi. In terms of human resources, the company prides itself on its dedicated team of 19,008 employees, which includes 110 contracted experts, who play pivotal roles in ensuring the company’s smooth operations.

Among the array of financial products offered by Muthoot Fincorp Limited, the following gold loan products are noteworthy:

- Muthoot Blue Guide Gold Loan

- Muthoot Blue Bright Gold Loan

- Muthoot Blue Power Gold Loan

- Muthoot Blue Bigg Gold Loan

- Muthoot Blue Smart Gold Loan

- 24×7 Express Gold Loan

In addition to its primary gold loan business, Muthoot Fincorp Limited extends its services to include foreign exchange conversion and money transfer services, acting as sub-agents for various registered money transfer agencies.

Furthermore, the company is engaged in diversified ventures, which include:

- The generation and sale of wind energy through its wind farms located in Tamil Nadu.

- Real estate activities through joint venture collaborations for developing land parcels owned by the company.

It’s important to note that Muthoot Fincorp Limited is also associated with Muthoot Fincorp NCD IPO, which likely represents an aspect of its financial offerings.

Muthoot Fincorp NCD IPO October Tranche II 2023 Detail

| Issue Open | October 13, 2023 – October 27, 2023 |

| Security Name | Muthoot Fincorp Limited |

| Security Type | |

| Issue Size (Base) | Rs 225.00 Crores |

| Issue Size (Shelf) | Rs 1,100.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE |

| Credit Rating | CRISIL AA- /Stable by CRISIL Ratings Limited |

| Tenor | 24, 36, 60 and 96 Months |

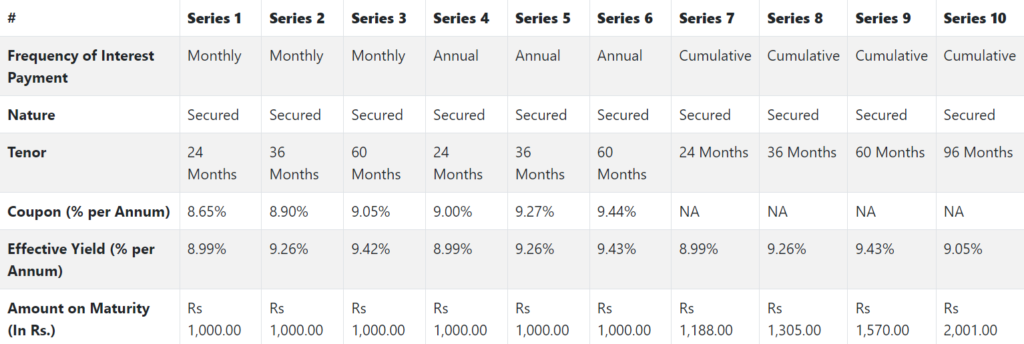

| Series | Series I to X |

| Payment Frequency | Monthly, Annual and Cumulative |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Vardhman Trusteeship Private Limited |

NCD Allocation Ratio

Muthoot Fincorp NCD IPO Coupon Rates

Company Promoters

Thomas John Muthoot, Thomas George Muthoot, and Thomas Muthoot are the company promoters.

Company Financials

Muthoot Fincorp Limited Financial Information (Restated Consolidated)

Muthoot Fincorp Limited’s revenue increased by 18.28% and profit after tax (PAT) rose by 56.69% between the financial year ending with March 31, 2023 and March 31, 2022.

| Period Ended | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 32,134.61 | 28,422.47 |

| Revenue | 5,151.33 | 4,355.13 |

| Profit After Tax | 646.42 | 412.55 |

| Net Worth | 4,257.18 | 3,731.16 |

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- For the purpose of Working Capital – 75% of the amount raised and allotted in this Tranche II Issue.

- For General Corporate Purposes – 25% of the amount raised and allotted in this Tranche II Issue.

In conclusion

Muthoot Fincorp NCD IPO, established in 1997, is a prominent non-deposit-taking NBFC known for its specialization in providing secured personal and business loans backed by gold ornaments and jewelry. With a substantial portfolio of around 31 lakhs of loan accounts as of June 30, 2023, and a wide-reaching network of 3,619 branches across 24 states, including the union territory of Andaman and Nicobar Islands and the national capital territory of Delhi, the company has firmly established its presence in the financial landscape.

The dedicated team of 19,008 employees, along with contracted experts, ensures the company’s operational excellence. Alongside its core gold loan business, Muthoot Fincorp Limited offers various gold loan products to cater to diverse customer needs. Additionally, the company extends its services to foreign exchange conversion, money transfers, and engages in the generation and sale of wind energy, as well as real estate ventures through joint ventures on its owned land parcels.

Muthoot Fincorp NCD IPO likely represents an integral part of the company’s financial offerings, further enhancing its comprehensive suite of services.

Keep reading and supporting Banknomics!