Established in the year 2018, Arka Fincap stands as a Non-Banking Financial Company (NBFC) dedicated to offering secured and unsecured financial solutions to a diverse clientele, including MSMEs, SMEs, developers, and corporate entities. The organization’s primary focus revolves around four key areas: corporate lending, financing for real estate and urban infrastructure projects, MSME lending, and personal loans. Additionally, Arka Fincap NCD IPO has made a significant mark in the financial landscape with its NCD IPO (Non-Convertible Debentures Initial Public Offering), further expanding its reach and influence in the market.

Operating across 17 cities in India, spanning the West, South, and North regions, Arka boasts a workforce of more than 300 employees. As a subsidiary of Kirloskar Oil Engines Limited (KOEL), the company has earned notable financial credibility, securing a rating of AA(-) for its long-term borrowings and A1(+) for short-term borrowings as evaluated by Crisil.

Arka Fincap NCD Tranche I Nov 2023 Detail

| Issue Open | December 7, 2023 – December 20, 2023 |

| Security Name | Arka Fincap Limited |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 300.00 Crores |

| Issue Size (Shelf) | Rs 500.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE |

| Credit Rating | CRISIL AA-/ Positive” by CRISIL Ratings Limited |

| Tenor | 24, 36 and 60 Months |

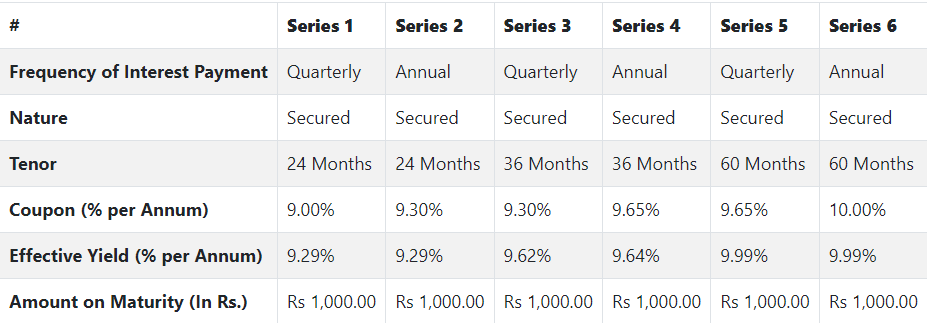

| Series | Series I to VI |

| Payment Frequency | Quarterly and Annually |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Catalyst Trusteeship Limited |

NCD Allocation Ratio

Arka Fincap Limited NCD Coupon Rates

NCD Rating

The NCDs proposed to be issued under this Issue have been rated CRISIL AA-/Positive by CRISIL Ratings Limited, with such ratings considered to have a stable outlook.

Company Promoters

The promoters of the company are Kirloskar Oil Engines Limited and Arka Financial Holdings Private Limited

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- For onward lending, financing, and for repayment of interest and principal of existing borrowings of the Company; and

- General corporate purposes.

Read More!

Keep reading and supporting Banknomics!