Established in 1995, IIFL Samasta operates as a Non-Banking Finance Company Micro Finance Institution (NBFC MFI) within the Indian financial landscape. The organization is dedicated to delivering innovative and cost-effective financial solutions to female members organized as Joint Liability Groups. As a subsidiary of IIFL Finance Limited, IIFL Samasta focuses on addressing the financial needs of underserved individuals lacking access to conventional banking services.

The company’s product portfolio is tailored to cater specifically to this demographic. It includes Income Generating Loans (IGL), designed to support the initiation or expansion of businesses, top-up loans, loans against property, micro-enterprise loans, and Lifestyle and Family Welfare loans.

The latter category encompasses financing options for products that can enhance the quality of life for individuals, such as loans for dairy cattle, sanitation and hygiene, as well as loans for acquiring daily-use items like cook stoves, water purifiers, mobile phones, and solar lights.

IIFL Samasta Finance NCD Tranche I Nov 2023 Detail

| Issue Open | December 4, 2023 – December 15, 2023 |

| Security Name | IIFL Samasta Finance Limited |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 1,000.00 Crores |

| Issue Size (Shelf) | Rs 2,000.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE, NSE |

| Credit Rating | CRISIL AA-/ Positive” by CRISIL Ratings Limited |

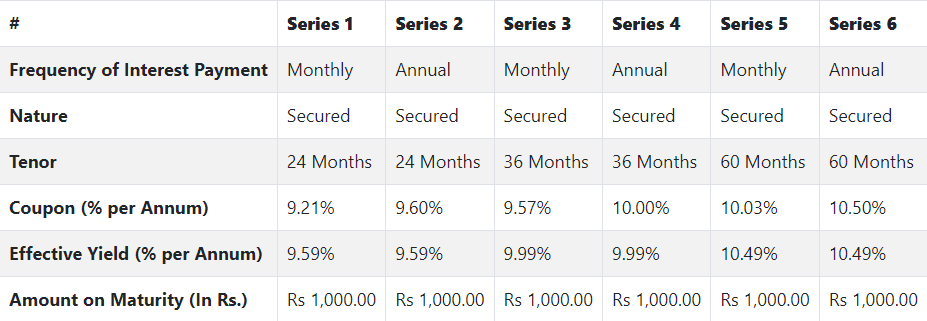

| Tenor | 24, 36 and 60 Months |

| Series | Series I to VI |

| Payment Frequency | Monthly and Annually |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Beacon Trusteeship Limited |

NCD Allocation Ratio

IIFL Samasta Finance Limited NCD Coupon Rates

NCD Rating

The NCDs proposed to be issued under this Issue have been rated CRISIL AA-/Positive by CRISIL Ratings Limited, with such ratings considered to have a stable outlook.

Company Promoters

The Promoters are Cholamandalam Financial Holdings Limited, Ambadi Investments Limited, M V Subbiah, M A Alagappan, A Vellayan, A Venkatachalam, M M Murugappan, M M Venkatachalam, M A M Arunachalam, S Vellayan, Arun Alagappan, M M Veerappan, V Narayanan, V Arunachalam, M M Muthiah, M V Muthiah, Arun Venkatachalam, M V Subramanian, M V Murugappan HUF, M V Subbiah HUF, M A Alagappan HUF, A Vellayan HUF, A Venkatachalam HUF, M M Murugappan HUF, M A M Arunachalam HUF, M M Venkatachalam HUF, M M Muthiah HUF, A M M Arunachalam HUF, Murugappa & Sons (M V Subbiah, M A Alagappan & M M Murugappan hold shares on behalf of the firm) Tube Investments of India Limited New Ambadi Estates Private Limited, Coromandel International Limited, Ambadi Enterprises Limited, Carborundum Universal Limited, E.I.D. Parry (India) Limited, M A Alagappan (holds shares on behalf of Kadamane Estates).

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- For onward lending, financing, and for repayment of interest and principal of existing borrowings of the Company; and

- General corporate purposes.

Read More!

Keep reading and supporting Banknomics!