Established in 1978, Cholamandalam Investment and Finance Company Limited (Chola) is a non-banking financial institution classified as an NBFC Investment and Credit Company (NBFC-ICC). It serves as the financial services division of the Murugappa Group.Cholamandalam Investment NCD IPO.

Chola initially specialized in equipment financing but has since diversified its offerings to include vehicle finance, loans against property, home loans, supply chain financing, term loans, equipment financing, loans against securities, and invoice discounting for small and medium-sized enterprises (SMEs). The company also provides consumer and small enterprise loans, secured business and personal loans, along with investment advisory services, stock broking, and various other financial services.

The organization boasts three subsidiaries:

- Cholamandalam Securities Limited (CSL), which delivers stock broking and depository participant services.

- Cholamandalam Home Finance Limited (CHFL), engaged in the distribution of insurance products.

- Payswiff Technologies Private Limited (PTPL), offering payment gateway services for e-commerce businesses and comprehensive e-commerce solutions.

Additionally, Cholamandalam Investment NCD IPO is part of the company’s financial services portfolio.

As of September 30, 2023, Chola operates through a network of over 1,267 branches and 571 resident locations across 29 States and Union Territories in India, catering to 30.94 lakh active customers.

Cholamandalam Investment NCD IPO Tranche III Nov. 2023 Detail

| Issue Open | November 28, 2023 – December 11, 2023 |

| Security Name | Cholamandalam Investment and Finance Company Limited |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 500.00 Crores |

| Issue Size (Shelf) | Rs 5,000.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE, NSE |

| Credit Rating | IND AA+/Stable by India Ratings & Research Private Limited and ICRA AA+ (Stable) by ICRA Limited |

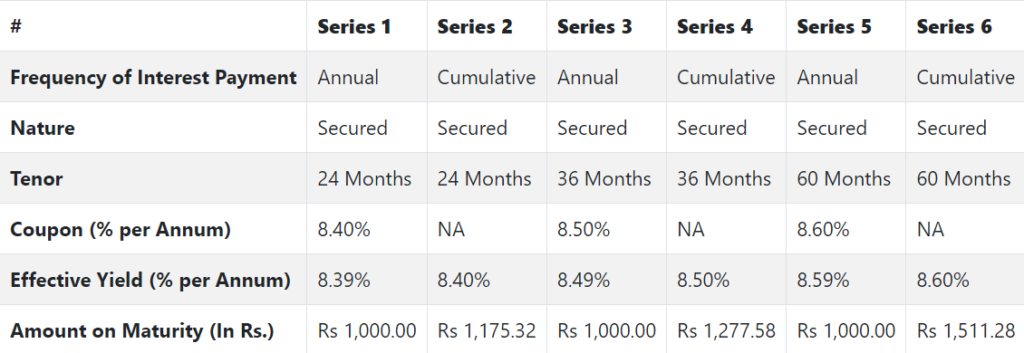

| Tenor | 24, 36 and 60 Months |

| Series | Series I to VI |

| Payment Frequency | Annually and Cumulative |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Idbi Trusteeship Services Ltd. |

NCD Allocation Ratio

Cholamandalam Investment NCD IPO and Finance Company Limited NCD Coupon Rates

NCD Rating

The company has been assigned a rating of ICRA AA+ (Stable) by ICRA Limited and IND AA+ (Stable) by India Ratings & Research Private Limited for the Non-Convertible Debentures (NCDs) intended to be issued as part of this offering.

Company Promoters

Cholamandalam Financial Holdings Limited, Ambadi Investments Limited, M V Subbiah, M A Alagappan, A Vellayan, A Venkatachalam, M M Murugappan, M M Venkatachalam, M A M Arunachalam, S Vellayan, Arun Alagappan, M M Veerappan, V Narayanan, V Arunachalam, M M Muthiah, M V Muthiah, Arun Venkatachalam, M V Subramanian, M V Murugappan HUF, M V Subbiah HUF, M A Alagappan HUF, A Vellayan HUF, A Venkatachalam HUF, M M Murugappan HUF, M A M Arunachalam HUF, M M Venkatachalam HUF, M M Muthiah HUF, A M M Arunachalam HUF, and Murugappa & Sons (represented by M V Subbiah, M A Alagappan, and M M Murugappan holding shares on behalf of the firm) are identified as the promoters of the company.

Additionally, Tube Investments of India Limited, New Ambadi Estates Private Limited, Coromandel International Limited, Ambadi Enterprises Limited, Carborundum Universal Limited, E.I.D. Parry (India) Limited, and M A Alagappan (holding shares on behalf of Kadamane Estates) are also associated with the company as promoters.

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- For the purpose of onward lending, financing, and for repayment of interest and principal of existing debt of the Company.

- General corporate purposes.

Read More!

Keep reading and supporting Banknomics!