Established in 1991, ICL Fincorp Limited operates as a non-banking financial company, focusing on extending loans secured by household gold jewelry in various states, including Kerala, Tamil Nadu, Andhra Pradesh, Karnataka, Telangana, Odisha, Gujarat, and Maharashtra. The company specializes in catering Gold Loans primarily to individuals from middle-class backgrounds. Additionally, ICL Fincorp Limited has made significant strides, as evidenced by its ICL Fincorp NCD IPO, showcasing the company’s commitment to expanding its financial offerings and reaching a broader market.

One of the notable strengths of the company lies in its efficient loan distribution process, positioning it as a reliable ally for customers facing financial challenges. ICL Fincorp Limited maintains an in-house team of professionals exclusively dedicated to the appraisal of gold, ensuring a precise, transparent, and impartial evaluation of customers’ gold assets. In line with a commitment to regulatory standards, the company strictly adheres to rigorous Know Your Customer (KYC) procedures.

ICL Fincorp NCD IPO Nov 2023 Detail

| Issue Open | November 28, 2023 – December 11, 2023 |

| Security Name | ICL Fincorp Limited |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 100.00 Crores |

| Issue Size (Shelf) | Rs 100.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE |

| Credit Rating | ACUITE BBB- with stable outlook by Acuité |

| Tenor | 13, 24, 36, 60 and 68 months |

| Series | Series I to X |

| Payment Frequency | Monthly, Annual and Cumulative |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Mitcon Credentia Trusteeship Services Limited |

NCD Allocation Ratio

NCD’s Offered by Category

| Category | NCD’s Reserved |

|---|---|

| Institutional | 10,000 |

| Non-Institutional | 40,000 |

| HNI | 200,000 |

| Retail | 750,000 |

| Total NCD’s | 1,000,000 |

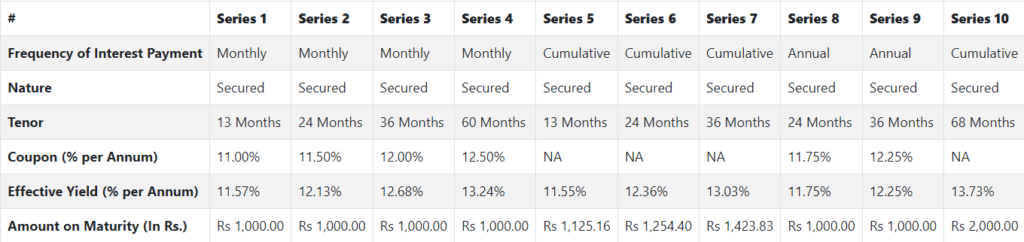

ICL Fincorp Limited NCD IPO Coupon Rates

NCD Rating

The NCDs proposed to be issued have been rated ‘ACUITE BBB-‘ by Acuité.

Company Promoters

The promoter of the company is Kuzhuppilly Govinda Menon Anil Kumar.

Objects of the Issue

The company proposes to utilise the funds which are being raised through the Issue towards funding the following objects

1. For the purpose of onward lending, financing, and for repayment/prepayment of principal and interest on existing borrowings of the Company

2. General corporate purposes.

Read More!

Keep reading and supporting Banknomics!