Established in 2005, Indiabulls Housing Finance Limited NCD IPO specializes in delivering mortgage lending services. This company functions as a non-deposit-taking housing finance entity, duly registered with the National Housing Bank (NHB).

Indiabulls Housing Finance Limited NCD IPO stands as one of the prominent housing finance corporations within India and serves as the flagship entity of the Indiabulls Group. Its primary offerings encompass housing loans and loans secured by property, catering to various segments including (i) salaried employees, (ii) self-employed individuals, (iii) micro, small, and medium-sized enterprises (MSMEs), and (iv) corporate clients. The company also extends mortgage loans to real estate developers in India, which include lease rental discounting for commercial spaces and construction finance for residential property development.

As of September 30, 2023, the company maintains a network of 218 branches spread across the country. Furthermore, the firm boasts a consolidated direct sales team consisting of 1,745 employees as of the same date. In terms of loan portfolio composition as of March 31, 2023, housing loans and non-housing loans accounted for 57% and 43%, respectively.

Indiabulls Housing Finance Limited NCD IPO holds a favorable long-term credit rating, with CRISIL and ICRA assigning it a rating of “AA” with a stable outlook, while CARE Ratings rates it as “AA” with a negative outlook for non-convertible debentures. Additionally, Brickwork Ratings provides a rating of “AA+” with a stable outlook for the company’s subordinated debt program.

Indiabulls Housing Finance NCD IPO Tranche III NCD Oct 2023 Detail

| Issue Open | October 20, 2023 – November 3, 2023 |

| Security Name | Indiabulls Housing Finance Limited |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 200.00 Crores |

| Issue Size (Shelf) | Rs 2,000.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | 10 NCD |

| Market Lot | 1 NCD |

| Listing At | BSE, NSE |

| Credit Rating | “CRISIL AA/Stable” by CRISIL Ratings Limited and “[ICRA]AA (Stable)” by ICRA Limited |

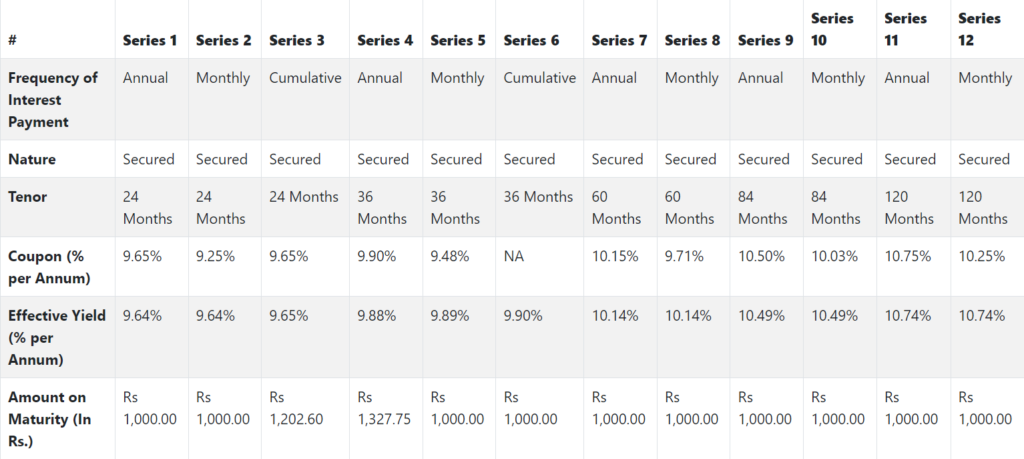

| Tenor | 24, 36, 60, 84 and 120 Months |

| Series | Series I to XII |

| Payment Frequency | Monthly, Annual and Cumulative |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Idbi Trusteeship Services Ltd. |

NCD Allocation Ratio

Indiabulls Housing Finance Limited NCD IPO Coupon Rates

NCD Rating

The NCDs proposed to be issued under this Issue have been rated CRISIL AA/Stable by CRISIL Ratings Limited and ICRA AA (Stable) by ICRA Limited with such ratings considered to have a stable outlook.

Company Promoters

The Company has no identifiable promoters and is a professionally managed company.

Company Financials

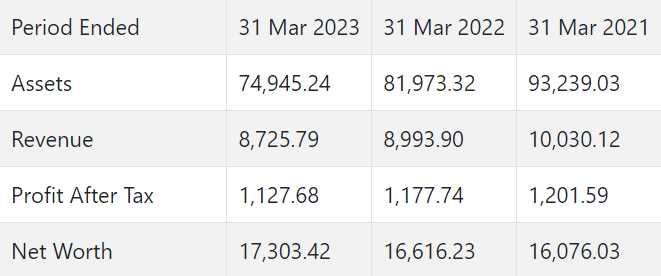

Indiabulls Housing Finance Limited NCD IPO Financial Information (Restated)

Indiabulls Housing Finance Limited’s revenue decreased by -2.98% and profit after tax (PAT) dropped by -4.25% between the financial year ending with March 31, 2023 and March 31, 2022.

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- For the purpose of onward lending, financing, and for repayment of interest and principal of existing borrowings of the Company; and

- General corporate purposes.

Keep reading and supporting Banknomics!