In today’s fast-paced world, financial assistance is often needed to fulfill our aspirations and meet urgent expenses. L&T Finance provide Housing Finance Loan, Personal Loan, Consumer Loan and Two-Wheeler Loan.

In this blog, we will delve into the key features and benefits of the L&T Finance Consumer Loan 2023, enabling you to make an informed decision when considering your financial needs and understands the importance of consumer loans and strives to provide flexible and hassle-free solutions to individuals. With their latest offering, L&T Finance Consumer Loan 2023, borrowers can avail themselves of quick approvals, flexible repayment options, and a completely digital process.

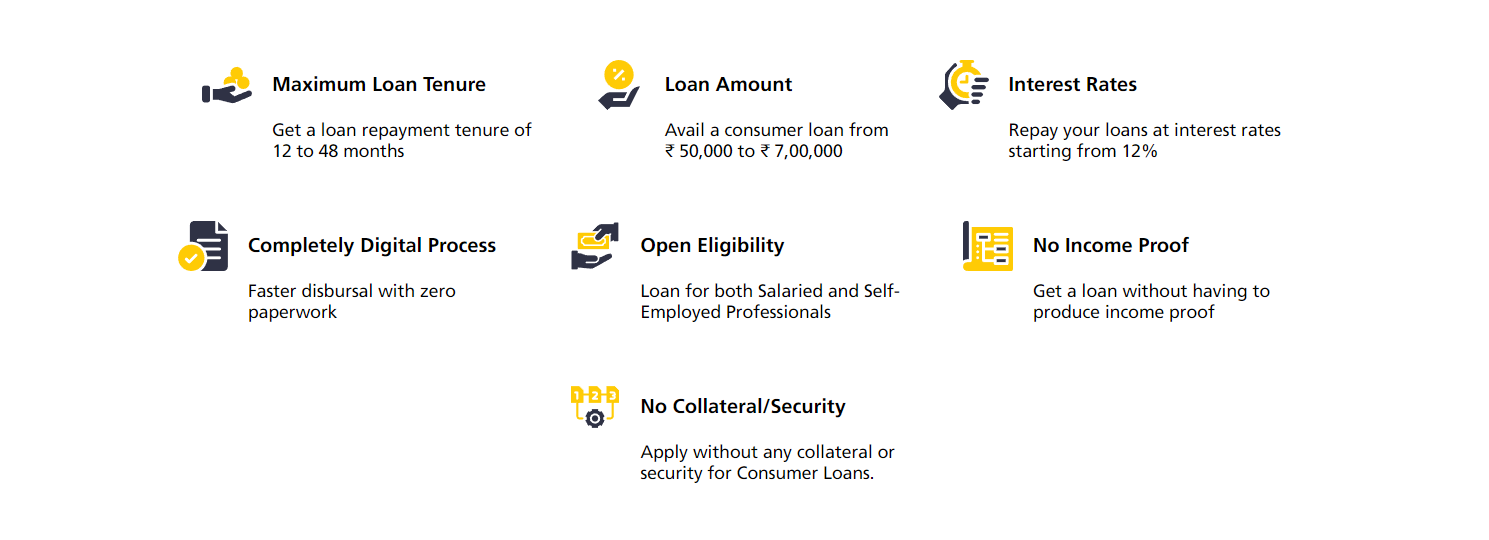

Maximum Consumer Loan Amount and Tenure:

L&T Finance Consumer Loan 2023 offers borrowers the freedom to choose loan amounts ranging from ₹50,000 to ₹7,00,000. This wide range allows individuals to meet their varying financial requirements effectively. Additionally, borrowers can enjoy a loan repayment tenure of 12 to 48 months, providing flexibility and convenience.

Image source -: https://www.ltfs.com/

Competitive Interest Rates:

One of the significant advantages of opting for L&T Finance Consumer Loan 2023 is the attractive interest rates starting from 12%. These competitive rates ensure that borrowers can manage their loan repayments without feeling burdened by excessive interest charges.

Quick Approvals and Completely Digital Process:

Gone are the days of lengthy paperwork and endless waiting. L&T Finance understands the importance of time and offers quick approvals with a completely digital process. This means borrowers can apply for a loan online, submit the necessary documents electronically, and experience faster disbursal of funds. Say goodbye to tiresome paperwork and hello to convenience.

Flexible Repayment Options for All:

L&T Finance Consumer Loan 2023 caters to both salaried individuals and self-employed professionals, making it accessible to a wide range of borrowers. Moreover, the repayment plans are designed to be flexible, ensuring that borrowers can comfortably repay their loans based on their financial capabilities.

Simple and Open Process Without Collateral/Security:

Applying for a consumer loan should be a hassle-free experience. With L&T Finance Consumer Loan 2023, borrowers can enjoy a simple and open process. There is no requirement for collateral or security, allowing individuals to obtain the loan without the stress of pledging their assets.

| Borrower | Documents |

|---|---|

| ID Proof: |

|

| Address Proof: |

|

| Income Proof (if required): |

|

Eligibility and Required Documents:

To avail of the L&T Finance Consumer Loan 2023, borrowers need to meet certain eligibility criteria. They should be Indian citizens with valid ID proof and fall within the age range of 23 to 58 years. The required documents include ID proof (Passport, PAN Card, Driver’s License, Voter’s ID, or Aadhar Card), address proof (Ration Card, Passport, Utility Bill, Voter’s ID card, or Driving License), and income proof (if required).

| Charge Type – Consumer Loans | Details |

|---|---|

| Processing Fee | Up to 2% of loan amount + applicable taxes |

| Repayment bounce charges | Rs.350/- + applicable taxes if any |

| Late payment interest | 3% per month on overdue EMI |

| Part Prepayment Charges | Up to 5 % of prepaid amount + applicable taxes Upto 25% allowed twice in a year. |

| Foreclosure Charges | 5% of principal outstanding + applicable taxes |

| Annual Maintenance charges | Nil |

| Legal /Recovery charges | As per actuals |

| Duplicate NOC charges (Charge is applicable for paper copy post 3 free copies per customer) | Rs 250/- + applicable taxes |

| Repayment swap charges (per swap) | Rs 500/- + applicable taxes |

| SOA/RPS /FC letter & other documents | Nil |

| Cooling-off/ look-up period during which Borrower shall not be charged any penalty on prepayment of loan | 3 Days |

| Loan cancellation charges post cooling off period of 3 days | 5% + GST on the outstanding loan amount |

Charges Associated with Consumer Loans:

While considering any financial product, it is crucial to understand the associated charges. L&T Finance Consumer Loan 2023 has a processing fee of up to 2% of the loan amount plus applicable taxes. Additionally, there are repayment bounce charges, late payment interest, part prepayment charges, foreclosure charges, annual maintenance charges, legal/recovery charges, duplicate NOC charges, repayment swap charges, cooling-off period, and loan cancellation charges. Familiarizing yourself with these charges will help you plan your loan repayment effectively.

Conclusion:

L&T Finance Consumer Loan 2023 is a reliable and flexible solution for individuals seeking financial assistance. With its wide range of loan amounts, competitive interest rates, quick approvals, and flexible repayment options, borrowers can meet their financial goals without unnecessary burdens. The completely digital process ensures convenience and saves time. Moreover, the open eligibility criteria and absence of income proof requirement make it accessible to both salaried individuals and self-employed professionals. So, if you’re in need of financial support, consider L&T Finance Consumer Loan 2023, and embark on a journey towards fulfilling your aspirations with ease.

Keep reading and supporting Banknomics!