The introduction should introduce L&T Housing Finance and its history. It should discuss the company’s mission and vision, and its products and services. For example, you could start by explaining that L&T Housing Finance is one of India’s leading housing finance companies. It was founded in 1987 and has since helped over 2 million people achieve their dream of homeownership. The company offers a wide range of products and services, including home loans, home improvement loans, and rental loans.

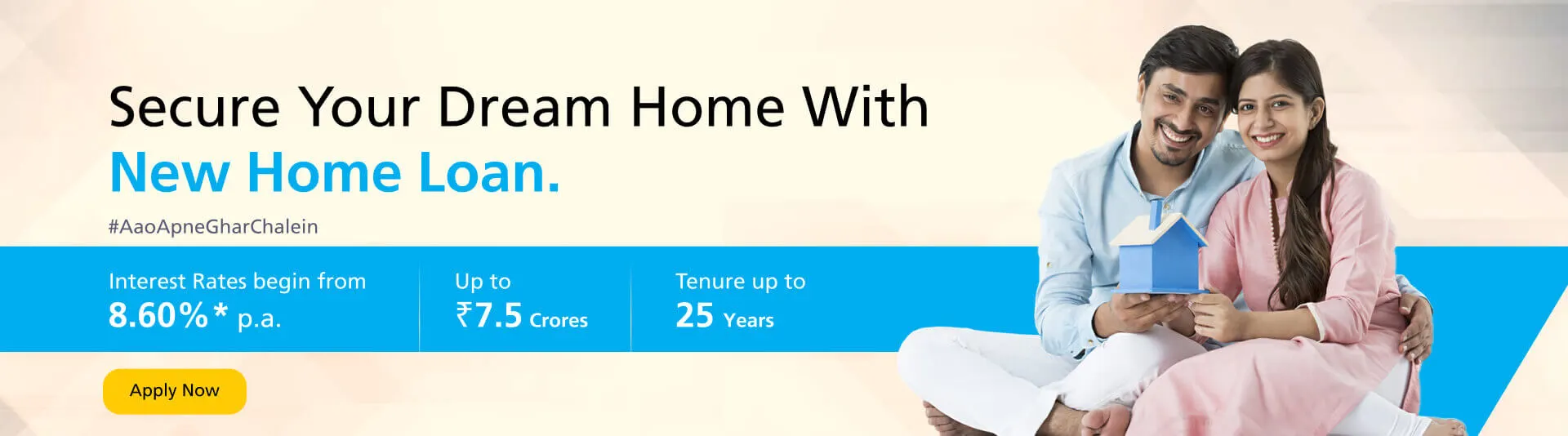

Image Source https://www.ltfs.com/our-products/housing-finance/home-loan

Key Feature

Why Choose L&T Housing Finance:

The next section should discuss the benefits of choosing L&T Housing Finance. For example, you could mention that the company offers low interest rates, flexible repayment options, and a comprehensive range of products. You could also point out that L&T Housing Finance has a strong track record of customer satisfaction.

| Charge Type -Home Loans | Details |

|---|---|

| Processing Fee | Upto 3% on Sanctioned Amount + applicable taxes |

| Repayment bounce charges | Rs.1,000/- + applicable taxes |

| Late payment interest | 3% per month on overdue EMI |

| Annual Maintenance charges | NA |

| Duplicate NOC charges (Charge is applicable for paper copy post 3 free copies per customer) | Rs 250/- + applicable taxes |

| Repayment swap charges ( per swap) | Rs 500/- + applicable taxes |

| Additional documents charges -SOA/RPS/FC letter /Interest Certificate | Nil |

| Valuation Charges | As per actuals |

| Documentation Charge | As per actuals |

| Cash pickup charge | Nil |

| Interest Rate Conversion Charge | Rs. 1000+GST |

| List of documents | Rs. 300/- +applicable taxes |

| Providing Photo copies of the documents | Rs. 500/- +applicable taxes |

| Charges incurred by LTFL for initiating action under Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act 2002 | · Issue of Loan Recall Notice = Rs. 500/ – · Issue of Demand Notice = Rs. 1,000/ – · Issue of Possession Notice = Rs. 2,000/ – · Applying District Magistrate Order = Rs. 8,000/ – · Taking Physical possession = Rs. 20,000/ – Actual cost incurred will be debited for expenses pertaining to Publication of Possession Notice / Publication Demand Notice / Publication of Sale cum Auction Notice. |

| Legal / Recovery Charges (Other than pertaining to SARFAESI) | As per actuals |

| Loan Cancellation Charges | Rs. 5000/- + applicable taxes |

| Recovery of proportionate actual expenses from disbursement date(s), from individual borrower(s) in | • Home Loan – Upto 0.75% of total disbursed loan amount + applicable taxes in case of closure within 18 months • LAP – Upto 1% of total disbursed loan amount + applicable taxes in case of closure within 24 months |

| Foreclosure / Full Prepayment Charges – Home Loan | For Individual Borrowers – • Floating Rate – Nil Charge • Fixed Interest Rate – other than own source of funds. • Less than 1 year from disbursement – upto 3% on principal outstanding + applicable taxes • Post 1 year of disbursement – upto 2% on principal outstanding + applicable taxes For Non – Individual Borrowers – (Applicant/Co – applicant) • Fixed & Floating rate loan – • Less than 1 year from disbursement – upto 3% on principal outstanding + applicable taxes • Post 1 year of disbursement – upto 2% on principal outstanding + applicable taxes |

| Pre-payment Charges – Home Loan | For Individual Borrowers – • Floating Rate – Nil Charge • Fixed Interest Rate – other than own source of funds. • Less than 1 year from disbursement – upto 3% on Partial / Prepayment amount + applicable taxes • Post 1 year of disbursement – upto 2% Partial / Prepayment amount + applicable taxes For Non – Individual Borrowers – (Applicant/Co – applicant) • Fixed & Floating rate loan – • Less than 1 year from disbursement – upto 3% on Partial / Prepayment amount + applicable taxes • Post 1 year of disbursement – upto 2% Partial / Prepayment amount + applicable taxes |

How to Apply for a Home Loan with L&T Housing Finance:

This section should explain the application process for a home loan with L&T Housing Finance. You should discuss the documents that you will need to provide, and the steps involved in the application process. For example, you could mention that you will need to provide proof of income, proof of identity, and proof of residence. You should also mention that the application process typically takes 7-10 days.

Documents Required to Apply for L&T Home Loan

For Salaried

- Age Proof/Photo ID Proof- PAN card. Aadhar Card

- Address Proof- Driving license, passport, utility bill, rent agreement, Aadhar card, voter ID

- Income Proof- Salary account bank statement for last 1 year, salary slip for last 3 months

For Self-employed Professionals

- Age Proof/Photo ID Proof- PAN card. Aadhar Card

- Address Proof- Driving license, passport, utility bill, rent agreement, Aadhar card, voter ID

- Income Proof- Latest 2 ITRs both personal and business along with computation of income Advance tax challans if available, advance tax challan if available, bank account statement for last 1 year, latest 2 years P&L account and B/S both personal and business duly certified by CA

For Self-employed Non-Professionals

- Age Proof/Photo ID Proof- PAN card. Aadhar Card

- Address Proof- Driving license, passport, utility bill, rent agreement, Aadhar card, voter ID

- Income Proof- Latest 2 years ITRs with computation for the individual applicants and co applicants (When borrower is an individual), latest 2 years audited / C.A. certified profit & loss accounts and balance sheets of the firm / company (When borrower is a firm / company), bank account statement for last 1 year

FAQs:

This section should answer some common questions about L&T Housing Finance. For example, you could answer questions about the eligibility criteria for a home loan, the documentation requirements, and the interest rates. You should also provide links to other resources where readers can find more information.

Conclusion:

The conclusion should summarize the key points of the blog post and encourage readers to contact L&T Housing Finance for more information. You could mention that L&T Housing Finance has a team of experienced professionals who can help you find the right mortgage for your needs. You should also provide contact information for the company.

Read More!

Keep Reading and Supporting Banknomics!