Established in 1939, Muthoot Mercantile Limited is a non-banking financial institution specializing in providing loans secured by assets such as gold, investments, health insurance, forex services, and money transfer. The company is also actively involved in Muthoot Mercentile NCD IPO (Non-Convertible Debentures), broadening its financial offerings to include this investment avenue.

The company maintains an extensive network of branches across Kerala, Tamil Nadu, Maharashtra, Odisha, Delhi, Haryana, Madhya Pradesh, Punjab, and Uttar Pradesh, and there are plans for further expansion. Headquartered in Thiruvananthapuram, a city in the southern Indian state of Kerala, Muthoot Mercantile Limited boasts a rich history in the lending industry, particularly focusing on small-scale loans secured by households and used gold jewelry. With 84 years of experience, the company has continually adapted and refined its operations.

Muthoot Mercentile NCD Nov 2023 Detail

| Issue Open | December 4, 2023 – December 15, 2023 |

| Security Name | Muthoot Mercentile Limited |

| Security Type | Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) | Rs 100.00 Crores |

| Issue Size (Shelf) | Rs 200.00 Crores |

| Issue Price | Rs 1000 per NCD |

| Face Value | Rs 1000 each NCD |

| Minimum Lot size | |

| Market Lot | 1 NCD |

| Listing At | BSE |

| Credit Rating | IND BBB/Stable by by India Ratings & Research Private Limited |

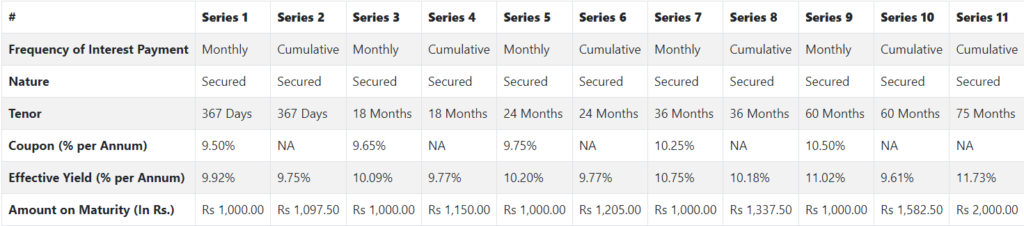

| Tenor | 367days, 18, 24, 36, 60, 75 months |

| Series | Series I to XI |

| Payment Frequency | Monthly and Cumulative |

| Basis of Allotment | First Come First Serve Basis |

| Debenture Trustee/s | Mitcon Credentia Trusteeship Services Limited |

NCD Allocation Ratio

Muthoot Mercentile Limited NCD Coupon Rates

NCD Rating

The NCDs proposed to be issued under this Issue have been rated “IND BBB/Stable”, by India Ratings & Research Private Limited

Company Promoters

The promoter of the company is Mathew Mathaininan

Objects of the Issue

The Company proposes to utilise the funds which are being raised through the Issue, after deducting the Issue-related expenses to the extent payable by the company towards funding the following objects

1.For the purpose of onward lending, financing and repayment/prepayment of principal and interest on existing borrowings

2. General Corporate Purposes

Read More!

Keep reading and supporting Banknomics!